Rate of return chapter 3 lesson 6 answer key – Embark on a journey to master the intricacies of rate of return with our comprehensive answer key for Chapter 3 Lesson 6. This guide delves into the fundamentals, applications, and limitations of this crucial investment metric, empowering you with the knowledge to make informed financial decisions.

Delve into the concept of rate of return, unraveling its significance in evaluating investment performance and comparing investment options. Discover the factors that shape ROR, including investment period, risk level, and inflation, and gain insights into the relationship between risk and return.

Rate of Return: Definition and Calculation

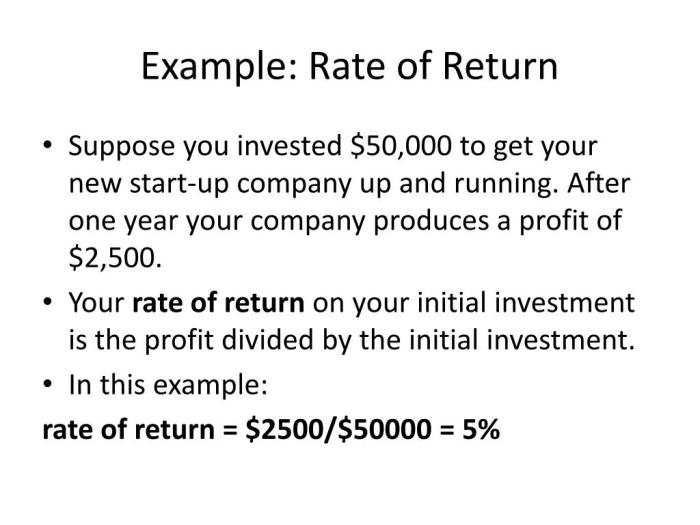

Rate of return (ROR) measures the percentage gain or loss on an investment over a specific period. It is a key indicator of investment performance and helps investors evaluate the profitability of their investments.

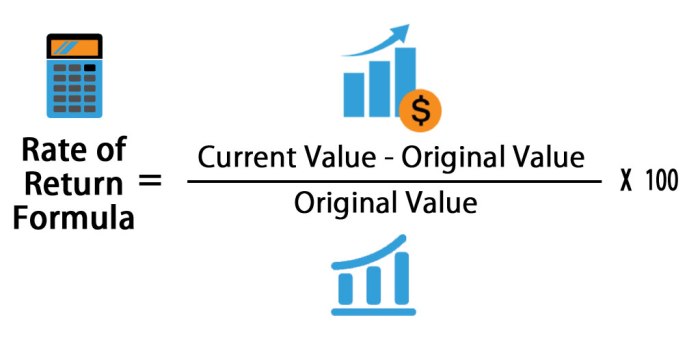

ROR can be calculated using simple or compound interest formulas:

Simple Interest ROR: (Ending Value

Initial Value) / Initial Value x 100%

Compound Interest ROR: ((Ending Value / Initial Value)^(1/n))

1 x 100%

Where:

- Ending Value is the value of the investment at the end of the period.

- Initial Value is the value of the investment at the beginning of the period.

- n is the number of years or compounding periods.

There are different types of ROR, including annualized ROR, nominal ROR, and real ROR.

Factors Affecting Rate of Return

Several factors influence the ROR of an investment, including:

- Investment period: Longer investment periods generally lead to higher RORs due to the effect of compounding.

- Risk level: Investments with higher risk typically offer higher RORs as compensation for the increased risk.

- Inflation: Inflation can erode the real value of returns, reducing the effective ROR.

The relationship between risk and return is positive, meaning that higher-risk investments tend to have higher RORs.

Examples of investments with different RORs include:

- Savings accounts: Typically low RORs due to low risk.

- Bonds: Moderate RORs with varying risk levels depending on the bond type.

- Stocks: Higher RORs but also higher risk due to market volatility.

Applications of Rate of Return

ROR is widely used in investment analysis and decision-making:

- Evaluating investment performance: ROR allows investors to assess the profitability of their investments and compare them to benchmarks or other investments.

- Comparing investment options: ROR helps investors identify investments with the potential for higher returns while considering risk levels.

- Financial decision-making: ROR is used in capital budgeting decisions, portfolio optimization, and risk management.

Limitations of Rate of Return

While ROR is a valuable tool, it has limitations:

- Time-dependent: ROR only measures returns over a specific period and may not reflect long-term performance.

- Does not consider liquidity: ROR does not account for the liquidity of an investment, which can affect its overall value.

- Tax implications: ROR does not consider the impact of taxes, which can reduce the effective return.

In certain situations, ROR may not be a reliable indicator of investment performance, such as when:

- Investments have irregular cash flows.

- There are significant changes in the investment’s value over time.

- The investment has a high degree of uncertainty or risk.

Advanced Concepts in Rate of Return

One advanced concept in ROR is the internal rate of return (IRR).

IRR is the discount rate at which the net present value of an investment is zero. It represents the effective annualized ROR of an investment and is used to evaluate the profitability of long-term projects.

IRR can be compared to other ROR measures, such as the annualized ROR, to provide a more comprehensive analysis of investment performance.

FAQ: Rate Of Return Chapter 3 Lesson 6 Answer Key

What is the formula for calculating simple interest rate of return?

Simple interest rate of return = (Interest earned / Principal) x 100%

How does inflation affect rate of return?

Inflation can erode the purchasing power of investment returns, reducing the real rate of return.

What is the difference between nominal and real rate of return?

Nominal rate of return reflects the actual return on investment, while real rate of return considers the impact of inflation.