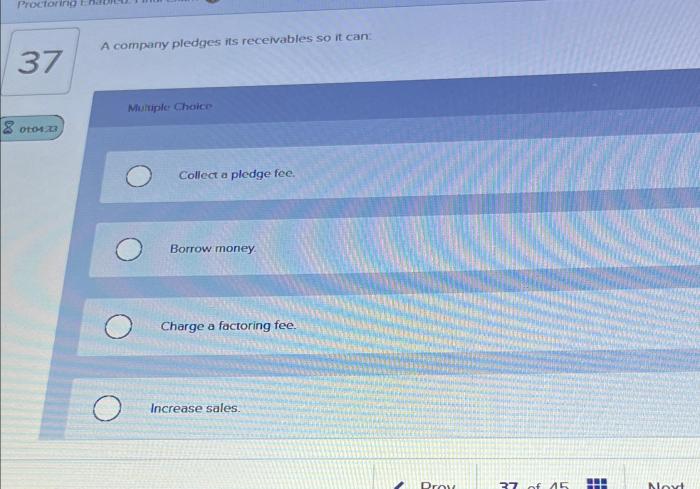

A company pledges their receivables so they may – In the dynamic world of business, companies often seek innovative ways to enhance their financial flexibility and support their growth aspirations. One such strategy is the pledging of receivables, where a company uses its outstanding accounts receivable as collateral to secure financing.

This practice has gained significant traction in recent years, as companies explore alternative funding sources and seek to optimize their working capital management. By pledging their receivables, companies can unlock liquidity, improve cash flow, and support their ongoing operations.

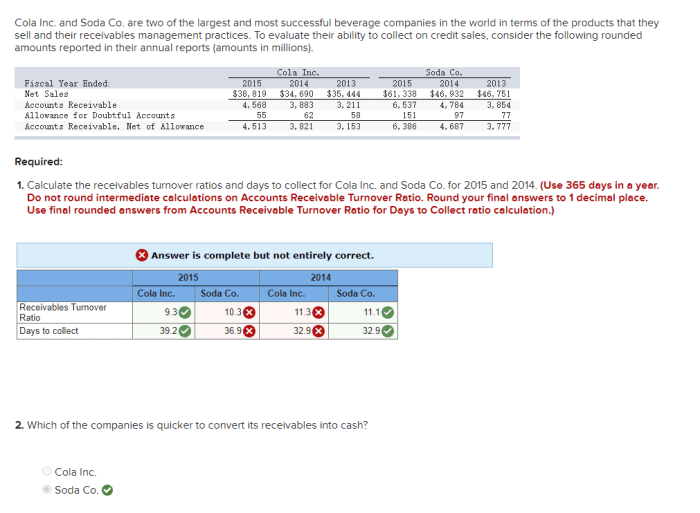

1. Company Pledges Receivables

When a company pledges its receivables, it uses its accounts receivable as collateral to secure a loan or line of credit. This allows the company to access financing without having to sell its receivables or take on additional debt.

Examples of how companies utilize pledged receivables include:

- Securing a loan from a bank or other lender

- Obtaining a line of credit to finance operations

- Raising capital for expansion or acquisition

Advantages of pledging receivables include:

- Access to financing without selling assets

- Lower interest rates compared to other forms of financing

- Improved cash flow by accelerating the collection of receivables

Disadvantages of pledging receivables include:

- Potential loss of control over receivables

- Covenants and restrictions imposed by the lender

- Risk of default if the company fails to meet its obligations

2. Legal and Regulatory Implications

Pledging receivables has several legal and regulatory implications that companies must consider:

- Secured Creditors:Lenders who hold a security interest in the receivables have priority over unsecured creditors in the event of a bankruptcy.

- Bankruptcy:In the event of bankruptcy, the pledged receivables may be used to satisfy the claims of secured creditors.

- UCC Filing:In most jurisdictions, companies must file a Uniform Commercial Code (UCC) financing statement to perfect their security interest in the receivables.

3. Accounting Treatment: A Company Pledges Their Receivables So They May

Under Generally Accepted Accounting Principles (GAAP), pledged receivables are classified as “collateralized receivables” and are recorded at their net realizable value.

Examples of how pledged receivables are recorded and reported in financial statements include:

- As a separate line item on the balance sheet

- Included in the notes to the financial statements

- Used to calculate financial ratios, such as the current ratio and the quick ratio

Pledging receivables can have a significant impact on financial ratios and metrics, as it reduces the company’s unencumbered assets and increases its liabilities.

4. Operational Considerations

Pledging receivables can have several operational implications for companies:

- Customer Relationships:Customers may be hesitant to do business with a company that has pledged its receivables, as it could indicate financial distress.

- Credit Management:Companies must carefully manage their credit risk when pledging receivables, as the lender may have recourse to the company if the customers default.

- Operational Risks:Companies must implement strong internal controls to prevent fraud and ensure the accuracy of their receivables records.

Companies can mitigate the operational risks associated with pledging receivables by:

- Selecting a reputable lender with a strong track record

- Negotiating favorable terms and conditions

- Implementing strong internal controls and procedures

5. Industry Best Practices

Industry best practices for managing and monitoring pledged receivables include:

- Regular Monitoring:Companies should regularly monitor their pledged receivables to ensure that they are being collected in a timely manner.

- Communication with Customers:Companies should communicate with their customers about the pledging of their receivables to maintain good relationships.

- Diversification:Companies should diversify their customer base to reduce the risk of losing a significant portion of their receivables due to a customer default.

Examples of how companies have successfully utilized pledged receivables include:

- A manufacturing company used its pledged receivables to secure a loan to finance the purchase of new equipment.

- A retail company used its pledged receivables to obtain a line of credit to finance its seasonal inventory purchases.

- A healthcare provider used its pledged receivables to raise capital for the construction of a new hospital.

FAQ Guide

What are the key advantages of pledging receivables?

Pledging receivables offers several advantages, including improved cash flow, increased liquidity, reduced borrowing costs, and enhanced working capital management.

Are there any legal or regulatory considerations associated with pledging receivables?

Yes, there are legal and regulatory considerations that companies must be aware of when pledging receivables. These include ensuring compliance with secured lending laws, protecting the rights of secured creditors, and navigating the impact of bankruptcy on pledged receivables.

How does pledging receivables impact financial ratios and metrics?

Pledging receivables can have a significant impact on financial ratios and metrics. For example, it can reduce a company’s current ratio and debt-to-equity ratio, while increasing its working capital ratio.